Affordable Clean Power Alliance Comments on Utility Owned Generation Questions

Case 15-E-0302 – Proceeding on Motion of the Commission to Implement a Large Scale Renewable Program and Clean Energy Standard.

COMMENTS OF AFFORDABLE CLEAN POWER ALLIANCE

On May 15, 2025, the New York State Public Service Commission (“Commission” or “PSC”) issued its Order Adopting Clean Energy Standard Biennial Review as Final and Making Other Findings in the above-captioned proceeding which, among other things, adopted several proposed modifications to the State’s Clean Energy Standard (“CES”) to reflect current market conditions and maintain progress on building renewable generation to achieve the Climate Leadership and Community Protection Act’s (“CLCPA”) target of having 70 percent of electricity generated by renewable energy systems by 2030 (“70 by 30 target”) and having the electricity sector be zero-emissions by 2040 (“100 by 40 target”).[1] Acknowledging the “sound rationales behind the establishment of the policy disfavoring utility-owned generation [“UOG”] that has been in place since the 1990s,” the Commission noted that “a lot has changed in the energy market since deregulation” and that there is value in exploring the option further as another avenue towards achieving the CLCPA goals.[2] The Commission posed a series of questions intended to better inform the Commission’s assessment as to whether changing the Commission’s policy disfavoring UOG might serve the interest of ratepayers (“Questions”).[3]

Pursuant to Commission’s July 30, 2025 Notice Soliciting Comments by September 26, 2025 and the subsequent extension of the filing deadline until October 31, 2025 within this case, New York’s Affordable Clean Power Alliance (“ACPA”) hereby submits these responses to the Commission’s Questions. Individual members of this coalition may submit additional comments to reflect their unique perspectives on the matter.

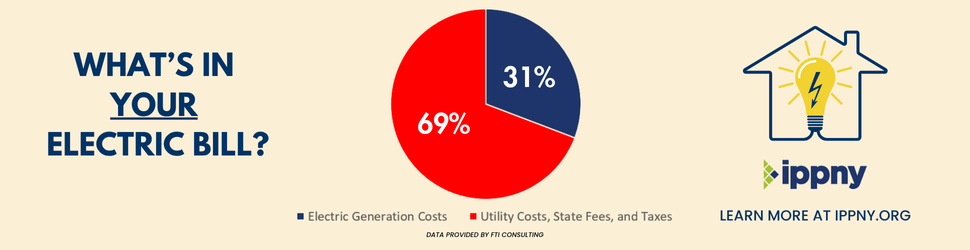

ACPA is a powerful, diverse coalition of leading energy associations including the Alliance for Clean Energy New York, Advanced Energy United, the Independent Power Producers of New York, Inc. (“IPPNY”), and New Yorkers for Affordable Energy. Formed around a unified vision, ACPA is dedicated to maintaining and advancing private investment in power generation across New York State and protecting electricity ratepayers from unnecessary risks and costs associated with UOG.[4] ACPA champions competitive market-based solutions that drive affordability and innovation as New York transitions toward a cleaner, sustainable energy future. ACPA advocates for policies that harness the power of competition to deliver clean, reliable, and cost-effective electricity, ensuring that the State remains at the forefront of energy transformation.

Investor-owned utilities (“IOUs”) have a critical role to play in attaining the 70 by 30 and 100 by 40 targets. However, the ownership and operation of new power generating facilities, whether, in this instance, distributed energy resources (“DERs”) or large scale renewable facilities, should not be one of those roles. Rather, we agree with, and continue to support, the policies previously articulated by the Commission that restrict regulated IOUs from owning and operating generation except in already authorized limited circumstances and situations.

The Commission should continue to prohibit UOG because the benefits do not outweigh the associated significant vertical market power (“VMP”) concerns and adverse impacts to the State’s competitive markets and ratepayers. Since the inception of the competitive markets in New York, the Commission has applied its policy to prevent the IOUs from exercising vertical market power (“VMP Policy”). This VMP Policy has prohibited the State’s IOUs from owning generation in New York unless the IOU demonstrated specific facts and circumstances that rebutted the presumption that ownership of generation by an IOU would unacceptably exacerbate the potential for VMP.[5] The separation of generation from transmission and distribution (“T&D”) has resulted in more competition, less market power risk, less ratepayer risk, and the entry of newer, cleaner, and more efficient energy suppliers. Utility ownership of generation would backtrack on that progress and set an uncompetitive and harmful precedent.

The Commission should not modify its current VMP Policy because it correctly determined more than two decades ago that the most effective way to allay VMP concerns arising from UOG is to prohibit it unless the IOU demonstrated it has rebutted the VMP presumption based on the specific facts and circumstances presented. Accordingly, and consistent with long-standing Commission policy, it is essential that IOUs continue to be prohibited from owning generation in New York to ensure affordability, consistency and market stability. The Commission’s decision has stood the test of time and continues to effectively and efficiently serve its intended purpose.

The best way for the Commission to protect ratepayers, while bringing more renewable energy generation online, is to continue to reform its procurement processes to ensure future Renewable Energy Credit (“REC”) solicitations alleviate the significant risk developers face, focus on flexible contracting to guarantee adaptability to the ever-changing landscape, and prioritize thoughtful planning for transmission upgrades that ultimately save ratepayers money. This approach will continue to foster competition among independent developers. Allowing IOUs to develop renewable energy generation projects does not solve the core problem the State has: the lengthy development timeline significantly increases costs and risks attrition. The longer the development timeline, the higher the risk of attrition for a project. Further, the riskier the project becomes directly increases the cost of capital, which leads to more expensive projects. This cycle ends up costing New Yorkers more because either projects bake the risk premium into their prices or face attrition and either start over with a higher price tag or never get built. While we greatly appreciate the work the Department of Public Service and the New York State Energy Research and Development Authority (“NYSERDA”) have done to evolve the solicitation processes, more can be done to derisk New York’s process which will ultimately lead to greater confidence from developers and lower prices for ratepayers.

Herein, ACPA responds to the Commission’s Questions.

1. What, if any, additional regulatory requirements would be needed to ensure effective and fair oversight of utility-owned generation, vertical market power concerns, and information asymmetry?

Through its VMP Policy, the Commission has already established an effective and fair oversight regime of UOG. The Commission was correct in identifying and addressing the issues associated with UOG when it first established the VMP Policy. Although the energy market is currently facing headwinds, UOG would be facing these same hurdles in permitting, financing, construction, and interconnection. The rationale behind the VMP Policy is sound, and changes in market conditions today do not alter the Commission’s well-founded reasoning. Moreover, the Commission’s VMP Policy Statement is a clear indicator to energy market participants that the Commission is committed to protecting the competitiveness of this state’s wholesale electricity markets. This commitment is critical for those considering doing business or making further investments in the state. The VMP Policy Statement addressed the problem with potential vertical market power:

Vertical market power occurs when an entity that has market power in one stage of the production process leverages that power to gain advantage in a different stage of the production process. A utility with an affiliate owning generation may, in certain circumstances, be able to adversely influence prices in that generator’s market to the advantage of the combined operation.[6]

The Commission identified the potential for VMP in two instances. First, VMP could be exercised when an IOU owns generation in its own service territory. The Commission was concerned that the IOU could use its control of the T&D system to favor its own generation or thwart competition by lowering competitors’ revenues, raising their costs, or delaying their projects.[7] Second, VMP could be exercised when an IOU owns generation that is located on the high side of a transmission constraint.[8] The Commission was rightly concerned that the IOU could use its control of the transmission system to increase constraints and raise the value of its generating assets.

The Commission reiterated the concern in its VMP Policy Statement that, as monopolies, the IOUs were uniquely situated to directly influence market conditions.[9] Likewise, the Commission highlighted the fact that the IOUs alone would possess system information about, e.g., potential upgrades in their service territories, that they could obfuscate thereby allowing them alone to forego action that would benefit consumers in order to benefit their own generation interests, and thus, their shareholders.[10]

Currently, interconnection issues are plaguing the timely connection of renewable generation projects to the grid. Utilities are not initiating grid upgrades even when given a multi-year timeframe. Generation projects are finding themselves operational but losing revenue as they wait for the utility to finish their needed improvements. In other cases, a utility asked distributed energy projects to cover additional interconnection costs due to errors by the utility in calculating the costs.[11] Utilities already hold significant market power over where and when generation projects are interconnected. The Commission should not grant them a financial incentive to expand their current market power over renewable generation projects.

From the outset of its move to competitive markets, the Commission correctly found that, in a wholesale or retail competitive model, the generation and energy service functions of the IOUs should be separated from their monopoly T&D functions, wherever feasible, to eliminate concerns related to the exercise of VMP and best meet the interests of ratepayers.[12] The Commission determined that the IOUs’ total divestiture of generation was the clearest way to allay concerns about their ability to exercise VMP and avoid anti-competitive behavior—such as favored treatment of affiliates and cross-subsidies among affiliates in both competitive and monopoly environments.[13] Finding that separating ownership of generation from T&D for IOUs was preferable to relying on regulatory controls and enforcement mechanisms because these mechanisms were incapable of timely identifying and remedying the potential for IOU abuse, the Commission established a rebuttable presumption that separating these functions was necessary.[14] ACPA supports the Commission continuing its current VMP Policy on IOU ownership as summarized in its first paragraph:

In creating a competitive electric market, the Commission has viewed divestiture as a key means of achieving an environment where the incentives to abuse market power are minimized. Recognizing that vigilant regulatory oversight cannot timely identify and remedy all abuses, it is preferable to properly align incentives in the first place.[15]

In addition, the Commission found that divestiture would help create a larger number of competing generating companies, which would result in a more dynamic market.[16] The Commission’s VMP Policy has been implemented with great success in bringing down electricity prices and bolstering the competitive market. The vast majority of new generation has been developed and operated by independent power producers (“IPPs”), State procurements have been richly responded to, and a competitive wholesale electricity market has been operating in New York for a quarter century, bringing consumers significant environmental, economic, and efficiency gains. The success of the VMP Policy is a testament to the Commission’s forward-thinking approach and collaborative efforts that have shaped New York’s present energy landscape.

NYSERDA’s 2024 RFP for wind and solar projects resulted in proposals from 38 projects totaling 3,500 megawatts (“MW”).[17] New York has a robust private sector generation market that is keeping energy prices low through competition. Over the past two and a half decades, the underlying market dynamics have not changed, and, as the Commission found in the initial VMP Policy Statement review, UOG will result in less competition and higher energy prices.

Since IOUs divested most of their generation more than 25 years ago, the Commission has applied its VMP Policy Statement on a case-by-case basis. This careful evaluation has helped determine whether, and under what circumstances, a company and its unregulated affiliates may be permitted to own both generation and transmission in New York. The Commission should continue to apply its VMP Policy Statement consistent with its precedents to UOG. The Commission should reject any argument that the public interest requires it weaken or abandon in any way its VMP Policy to accelerate the development of renewable resources. Competition’s long-standing benefits to ratepayers would be jeopardized if the Commission were to stray from its current well-considered course. Utility development or ownership of generation will not result in more projects being constructed faster. UOG will have to face the same timeline in seeking permits, in negotiating with landowners and local governments, and in acquiring equipment and labor.

Ownership of renewable generation by the IOUs is not necessary to meet the State’s 70 by 30 target and will not hasten, or make less costly, development of renewable projects. NYSERDA has a substantial program to meet this target in a competitive manner. Each time it has issued solicitations under the CES program, it has received substantial interest and proposed investment offers.[18] Indeed, despite the inflation and supply chain constraints identified in the Biennial Review, NYSERDA’s most recent solicitation contained provisions to address these areas (as indicated below). Clearly, NYSERDA is not lacking development opportunities with IPPs to meet the 70 by 30 target that would warrant the Commission weakening its VMP Policy Statement.

The Commission's assessment of UOG should also consider the broader market context in which New York's clean energy transition is occurring. It is notable that, although IOUs cite challenges in renewable energy deployment as justification for potential ownership models, they are not procuring renewable energy through competitive mechanisms in New York, as they are mandated to do in other states. This foregone opportunity represents a missed contribution, given that an additional buyer (in combination with NYSERDA) could meaningfully support renewable energy market development and project financing.

Renewable projects in New York have limited contracting opportunities, largely relying on NYSERDA solicitations. Utility contracting of renewable energy through competitive mechanisms provides developers with credit-worthy counterparties and long-term revenue certainty that facilitates project financing and market growth, benefits that could enhance New York's clean energy transition without requiring ownership model changes.

Additionally, the pace of renewable energy deployment has been influenced by various factors within utility operational control, including interconnection processes and transmission system planning. The Commission should continue to focus on improving these foundational competitive market mechanisms, rather than altering ownership structures. Further, the Commission should address deployment challenges while preserving the competitive market benefits that have served New York homes and businesses exceedingly well since restructuring.

In addition to addressing issues in interconnection and transmission planning, the PSC should improve the procurement process, making it easier to develop projects in this state and reduce project attrition. Changes to the procurement process would result in more projects participating in solicitations and more generation coming online as projects are completed. Addressing the issues in the current solicitation process would lead to lower cost projects and expose ratepayers to less financial risk than UOG.

Furthermore, the causes of divergence between the pace of renewable resource development and the State’s decarbonization goals identified in the Biennial Review are not due to the developers being IPPs. By their very nature, delays caused by global interest rates, inflation, supply chain pressures, community opposition, and the interconnection process would impact any entity’s, including IOUs’, ability to proceed with project development. NYSERDA has already begun to modify its solicitations to address some of the causes of delay identified in the Biennial Review. In NYSERDA’s most recent solicitation, RESRFP25-1, proposers may submit an Alternate Bid Proposal with a price structure where the Index REC Strike Price or Fixed REC Price would be subject to a one-time adjustment to reflect changes in a pre-determined price index.[19] Further, since the Commission established a framework of a limited set of circumstances that would permit IOU ownership of DERs,[20] nothing material changed.

With respect to the assertions that utilities are inherently better project managers than IPPs, this is patently false. We need to look no farther than some recent experiences in this state to discover that the utilities’ planning functions are no better than, and potentially considerably worse than, those of IPPs. Two salient examples include that, in 2022, four large scale wind projects were completed on time by their IPP developers, per the schedules laid out in the Interconnection Agreements, but they were unable to deliver power to the grid for 9-14 months beyond the planned-for operations date because their respective interconnecting utilities had failed to assign staff to manage their scopes and had not ordered the long-lead items required for completion. For another example, we can look at NYSEG’s delays in performing the Phase 2 transmission upgrades for which they were awarded ~$2 billion. Many of the projects in that approval group have been delayed four years or more, and the cited reasons include very foreseeable issues - that permitting takes longer than they initially assumed it would and that supply chain delays make procurement of long-lead items take longer than they assumed.

As for the cost of capital to which utilities have access, it is true that utilities have a low cost of capital, due to the ability to recover all costs from ratepayers. There is, however, no evidence that it is lower than that of many of the IPPs operating in New York already, whose good credit is based on their reliable ability to deliver projects on time and on budget. Utilities’ low cost of capital is based on their low risk profile, which is supported by the fact that any project cost overruns will be underwritten by the ratepayers of this state. This very mechanism of ratepayer exposure to generation costs is why the ratepayers of the Long Island Power Authority (“LIPA”) are still paying for the Shoreham nuclear plant. That risk transfer onto the ratepayer is not, in this current circumstance, a good rationale for UOG. In fact, it argues that UOG incents all the wrong behavior by utilities and is the very reason it was foreclosed by the Commission over 25 years ago.

All of the reasons private developers have struggled to bring projects forward in recent years would affect a regulated utility trying to do so also. In fact, the New York Power Authority (“NYPA”) identified some of these same issues in its Draft Strategic Plan issued October 8, 2024. NYPA acknowledged that it, a state-owned utility, must carefully navigate these risks in project development. Additionally, utilities’ unregulated affiliates were among those that terminated their NYSERDA contracts alongside so many other private developers in 2023.

2. What does an ownership model look like if the clean energy project is owned by and located outside of the utilities’ service territory?

Only the IOUs’ unregulated affiliates, in addition to IPPs, should be permitted to own generation in New York. In addition, these unregulated affiliates should be limited to owning projects outside of an IOU’s service territory and be required to compete in the wholesale energy markets to recover their costs and rebut the presumption that ownership of generation by an IOU (in this case an affiliate) would unacceptably exacerbate the potential for VMP. Allowing generation to be owned by IOUs, whose costs are recovered from captive ratepayers through cost-of-service ratemaking, would be a major reversal of the Commission’s long-standing and successful VMP Policy that generation should be owned by independent companies that rely on competitive markets for their cost recovery – NOT captive ratepayers.

The Commission’s decision more than a quarter century ago to restructure New York’s energy markets from vertically integrated monopolies to a competitive wholesale and retail market structure was based on competition bringing forth efficiencies, technical advancements, savings, and other benefits, which are unlikely to occur as effectively, if at all, absent the motivation provided by such competitive markets.[21] The successful energy outcomes, since the Commission made this pivotal VPM Policy decision, affirm that its reasoning was sound.

As demonstrated in the Competitive Power Benefits for New Yorkers report (“FTI Report”), filed with the Commission in this case on March 26, 2025, IOU-ownership of generation poses substantial risks of increased costs to ratepayers, chilling private investment in clean generation and energy storage, and slowing achievement of the State’s climate goals.[22] Many positive benefits have been gained since the market transition, including more efficient operation, substantially increased power plant availability and reliability, and new investment in renewable energy and demand-side programs. Such success has been due, in significant part, to the fact that rules and program designs have been structured carefully, wherever possible, to provide market-based mechanisms that ensure a level playing field for all competitors. Even where incentive payments have been authorized, the program structure was designed to be as compatible with, and to minimize impact on, the competitive markets. Consequently, and undeniably, New York homes and businesses have received these benefits without the risk of incurring stranded costs as would otherwise have been the case under regulated utility operations.

In a ratepayer cost-of-service model under UOG, ratepayers would face increased risk with respect to costs because IOUs are not incentivized to minimize costs. Competitive suppliers are incentivized to complete projects on time and at the lowest possible cost because they have to offer electricity into the market at competitive prices. IOUs have no such incentive and can pass the expense of delays and cost overruns on to captive ratepayers.[23] The FTI Report provides several examples where IOUs, both in New York and nationally, have incurred cost overruns that were ultimately borne at the expense of captive ratepayers.[24]

Similarly, a lack of competition increases the risk of poor performance. The FTI Report demonstrates that IOU cost-recovery can leave ratepayers on the hook for engineering and project management failures, including Vogtle Nuclear Plant expansion with cover runs of $21 billion.[25] In the worst case scenario, the risk to ratepayers “is not that costs will be higher than expected but that they will pay for failed or cancelled projects.”[26] Moreover, higher rates, due to IOU-owned renewable projects, could contribute to community backlash against renewable generation projects more broadly.

In addition, the prospect of UOG poses a significant risk of distorting the well-functioning competitive market. The FTI Report provides compelling evidence that the State’s transition to a competitive market has resulted in substantial benefits to consumers through lower power costs, declining emissions, and economic growth. Between 1996 to 2023, average retail electric rates in states with restructured electricity markets declined by 13.3 percent, compared to 2.9 percent declines in vertically integrated states.[27] Critically, the FTI Report notes that, since 2000, “emissions rates in states that generate a majority of their power from competitive markets have declined faster than states in which the majority comes from utility-owned plants.”[28]

These cost savings and emission reduction benefits would be jeopardized if IOUs are allowed to own new generation. Competitive markets are harmed by cost-of-service, rate-regulated generation because it can artificially depress the market clearing price from competitive levels. The uneconomic nature of cost-of-service, rate-based generation leads merchant companies interested in developing generation assets in this state to dedicate their limited resources elsewhere, thereby harming the competitive market and ultimately consumers. As private investment wanes, more projects will need to be built by the monopoly IOUs, which are typically unresponsive to price efficiencies and reluctant to innovate. As a result, they would dominate the development of generation projects, stifling competition and continued progress in the market.

Accordingly, the Commission should continue its long-standing policy prohibiting IOUs from owning new generation. The Commission should continue to allow the IOU-unregulated affiliates, in addition to IPPs, to own generation in this state. The unregulated affiliates, like all companies that are affiliated with generation and transmission in New York, should continue to be subject to the Commission’s VMP review and limited to areas outside of the utility’s territory. The Commission’s orders addressing VMP issues demonstrate that this practical approach has been effective and protected the interests of ratepayers.

The Commission applied its VMP Policy Statement when it conditioned its approval of Iberdrola, S.A.’s (“Iberdrola”) acquisition of two IOUs, Rochester Gas and Electric Corporation (“RG&E”) and New York State Electric and Gas Corporation (“NYSEG”), on the divestiture of any and all fossil-fueled generating assets in the state they owned and prohibited the future construction or acquisition of any fossil-fueled generation in New York by Iberdrola and its affiliates based on the specific facts and circumstances presented in that proceeding.[29] The Commission did allow NYSEG and RG&E to continue to develop a limited amount of wind generation in their service territories that had previously been proposed by Iberdrola. However, it did so based on its finding that substantial ratepayer benefits, together with mitigation measures, including the requirement that the generation must be owned by affiliates separate from the IOUs, overcame the presumption in that case that would have otherwise barred an IOU from owning generation.[30] This instance is a perfect example of how the Commission’s policy is effective at protecting ratepayers without overly Draconian enforcement.

In 2007, the Commission found the joint proposal to support the merger of National Grid PLC (“National Grid”) and KeySpan Corporation to be deficient because it would have permitted National Grid to own generating facilities while its affiliate, Niagara Mohawk Power Corporation, owned significant transmission that transmitted electricity from upstate to downstate.[31] Given National Grid’s substantial ownership of T&D assets at that time, the level of competition among wholesale suppliers then in New York City and the size and capacity factor of the generation assets, the Commission addressed VMP considerations in its merger order by requiring National Grid to divest the 2,450 MW Ravenswood generating facility portfolio as an express condition to approval of the merger given the specific facts and circumstances then presented.[32] The Commission explained why it adopted this condition:

For more than 12 years, this Commission has taken numerous actions to develop competitive markets for generation products in New York. The long-term goal is that customers should be able to obtain generation products by paying prices resulting from a fully competitive generation market in lieu of regulated prices (or rates) based on the costs of generation.[33]

Finding other proposed mitigation measures insufficient to adequately address vertical market power concerns, the Commission held, “[w]e agree with IPPNY and others that a decision by us to rely solely on regulatory solutions would signal and in fact would amount to a weakening of our resolve to ensure a competitive generation market and its attendant benefits.”[34]

In 2021, the Commission issued a declaratory ruling finding that one of National Grid’s unregulated affiliates, NGV Ventures Emerald, LLC (“NGV”), had adequately mitigated the VMP risk posed by the affiliate’s 50 percent ownership interest in a 22.9 MW solar facility on Long Island.[35] The Commission rejected NGV’s argument that its ownership of the facility presented no VMP risk due to the small size of the solar facility. However, while NGV’s 50 percent ownership interest resulted in a VMP risk, the Commission approved the ownership arrangement finding that the VMP risk was sufficiently mitigated by several factors, including the small size of the facility, the capacity factor of solar facilities, and that the facility was under a 30-year purchased power agreement (“PPA”) to sell all of its energy, capacity, and renewable attributes to LIPA at set prices that would not be impacted by future market conditions. In addition, the Commission noted that, upon expiration of the PPA, the VMP risk re-emerges, and NGV will need to further demonstrate why NGV's continued ownership of the project conforms with the VMP Policy Statement.

The Commission has also applied its VMP Policy to companies and their affiliates that are not IOUs where such companies propose to own both transmission and generation in New York. In another transaction involving the Ravenswood facility, the Commission required the proposed owner of Ravenswood, which was affiliated with a company proposing to construct and own transmission facilities in New York, to divest either the Ravenswood facility or the transmission facility and to adhere to certain mitigation measures if the New York Independent System Operator (“NYISO”) selected the transmission project for cost recovery under its tariff. Attesting to the flexibility of the Commission’s case-by-case review, the Commission removed the requirement for divestiture of the Ravenswood facility in 2022, finding that upon reconsideration, “substantial potential ratepayer benefits now exist, along with adequate mitigation measures, to overcome the presumption of VMP” because the VMP concern associated with a proposed transmission line did not materialize because the line was no longer proposed to be routed to New York City.[36]

These cases demonstrate that the Commission’s flexible case-by-case VMP analysis has successfully protected ratepayer interests in a variety of circumstances. Accordingly, the Commission should continue its case-by-case VMP analysis for any proposals for UOG.

3. Would projects be selected through a request for proposal process or other competitive mechanism? What is the proposed role of the Commission for oversight of this process? Would projects be developed by the utilities or purchased through build transfer agreements or other mechanisms?

For the reasons stated above, ACPA does not support regulated IOUs owning or operating renewable projects regardless of how proposals are selected. Only IOU-unregulated affiliate entities’ ownership of renewable generation outside of the IOU’s territory (in addition to IPPs) should be selected through a competitive solicitation process, purchased by another IPP entity through build to transfer agreements, or some other competitive mechanism. Importantly, IOU-unregulated affiliate entity-owned projects should be able to compete for competitive Tier 1 RECs like any other Tier 1 project.

4. How would the Renewable Energy Certificates (“RECs”) that utility owned projects generate be utilized? Will the utility keep the RECs on behalf of their customers, sold to NYSERDA, sold to other entities such as large volume customers, or some sort of prescribed blend? How will value of such RECs be determined?

Again, for the reasons stated above, ACPA does not support regulated IOUs owning or operating renewable projects. Only the IOU-unregulated affiliate entity-owned projects outside of their IOU territory should be subject to the same REC auction and award processes as non-IOU projects. IOU-unregulated affiliate projects should be required to compete with all the other non-IOU projects in NYSERDA auctions and be required to sell the RECs they generate to NYSERDA under the same program rules. If an IOU-affiliated project does not obtain a REC contract from NYSERDA, the project should be able to dispose of the RECs it generates as it chooses, so long as the Commission determines that those REC transactions do not raise any market power issues. Similarly, rules governing the transaction and calculation of the RECs associated with IOU-affiliate projects should be consistent with the currently effective rules and, by extension, consistently applied to non-IOU-unregulated affiliate projects.

5. How would utility-owned projects be financed? If ratepayer funded, how and at what point in the process? Are costs allocated to the utilities rate base, or statewide through the load-share ratio or similar mechanism? If ratepayer funded, how would financial net benefits accrue to ratepayers/customers? Would they go to the customers of record at the time any benefits are realized via a credit (or similar) or remitted to the State for overall clean energy compliance obligations?

Again, for the reasons stated above, ACPA does not support regulated IOUs owning or operating renewable projects. Additionally, as explained in ACPA’s response to Question 2, IOU-unregulated affiliate projects should be financed under a competitive model and should, under no circumstances, be financed under a rate-based, cost-of-service model.

UOG poses a serious risk to ratepayers for underperformance or higher than-expected construction, operation, and maintenance costs. It will be difficult for the State to effectively monitor costs in rate cases. The PSC has repeatedly decided against authorizing utilities to own renewable energy generation. Allowing utility ownership would undermine this competition, given that utilities: can recover all costs from ratepayers; can control the length and expense of the interconnection process; could raise unsettling vertical market power concerns; and can choose to procure their own generated electricity rather than the least-cost electricity.

Utilities already develop, own, and operate renewable projects, and do so, through their unregulated affiliates. There is also not a shortage of private developers working in this state currently. Over 14,000 MW of clean energy generation have completed the NYISO’s interconnection process in just the past six years,[37] so adding more players on the field without important differentiation in attributes, while incurring significant drawbacks, does not merit the risk to ratepayers.

6. Who bears the project development risk? What, if any, impact to ratepayers will unsuccessful projects have? How can the utility minimize ratepayer exposure to project development risk?

Again, for the reasons stated above, ACPA does not support regulated IOUs owning or operating renewable projects. The Commission should continue to protect ratepayers from unnecessary risk from UOG. Currently, IOU-unregulated affiliates are permitted to develop renewable generation assets, and, as discussed above, the IOU-affiliated entities alone bear the risks of project development. Because an IOU-unregulated affiliated entity does not have captive ratepayers, if an IOU-unregulated affiliate’s project is unsuccessful, New York ratepayers are fully shielded from unsuccessful project cost recovery, which is instead borne by investors. Such a model puts IOU-unregulated affiliates and IPPs on a level playing field in terms of the NYISO’s competitive markets, while also protecting ratepayers from the costs of unsuccessful investments if utilities owned generation.

7. Are there additional performance, measurement, and reporting requirements a utility-owned generation project should be subject to?

Again, for the reasons stated above, ACPA does not support regulated IOUs owning or operating renewable projects. Consistent with ACPA’s response to Question 2, the additional performance, measurement, and reporting requirements posed on IOU-affiliated projects should vary based on the case-by-case analysis of VMP conditions that the Commission performs to address VMP concerns for each project. The market circumstances that surround each IOU affiliate-owned project proposal vary and, therefore, the reporting and mitigation measures necessary to allay those concerns will also vary. As reflected in the Commission’s decisions on VMP to date, the circumstances surrounding a particular proposal may require the divesture of certain generation or transmission assets, while other proposals may be sufficiently mitigated merely by enhanced regulatory oversight or PPAs. The Commission should err on the side of protecting ratepayers from the dangers of VMP and cost overruns from IOU-owned projects.

The Affordable Clean Power Alliance looks forward to further engagement with the Commission as it continues this important comprehensive review dictated by the Biennial Review Order. Due to the complexity of policies and practices for developing energy generation in this state, we encourage the Commission to conclude its examination of utility-owned generation assets by continuing to prohibit it and instead to pivot its efforts to address the existing and well-known barriers to the deployment of large scale renewables, such as transmission capacity, interconnection reform, and siting and permitting delays. The Affordable Clean Power Alliance’s members will continue their involvement on this topic as additional opportunities and more in-depth discussions arise related to accelerating the deployment of large scale renewables.

Given its effects on distorting the competitive market, and the risk to ratepayers in underwriting any cost overruns, the Affordable Clean Power Alliance respectfully requests that the Commission reaffirm its long-standing policy prohibiting utility-owned generation.

[1] Case 15-E-0302, In the Matter of the Implementation of a Large-Scale Renewable Program, Order Adopting Clean Energy Standard Biennial Review as Final and Making Other Findings (May 15, 2025) (“Biennial Review Order”).

[2] Id. at 63, 65.

[3] Id. at 65–66.

[4] The views expressed herein are not necessarily the views of any individual members of the member associations.

[5] Cases 96-E-0900 et al., In the Matter of Orange & Rockland Utilities, Inc.’s Plans for Electric Rate Restructuring Pursuant to Opinion 96-12, Statement of Policy Regarding Vertical Market Power (July 17, 1998) (“VMP Order”); id. at Appendix I (“VMP Policy Statement”).

[6] VMP Policy Statement at 1.

[7] Id.

[8] Id.

[9] VMP Order at 5.

[10] See id. (noting IOUs could use their T&D monopolies “to act or fail to act so as to increase the profitability of their parent at the expense of ratepayers”).

[11] Case 23-E-0730 https://documents.dps.ny.gov/public/MatterManagement/CaseMaster.aspx?Mattercaseno=23-E-0730

[12] Id.

[13] Cases 94-E-0952 et al., In the Matter of Competitive Opportunities Regarding Electric Service, Opinion and Order Regarding Competitive Opportunities for Electric Service (May 20, 1996), at 64–65 (“Opinion 96-12”).

[14] VMP Policy Statement at 1.

[15] Id. (emphasis added.)

[16] Opinion 96-12 at 65.

[17] NYSERDA RESRFP24-1 Step Two Bid Proposal Map, https://www.nyserda.ny.gov/All-Programs/Large-Scale-Renewables/RES-Tier-One-Eligibility/Solicitations-for-Long-term-Contracts/RESRFP23-1-Step-Two-Bid-Proposal-Map

[18] See 2017 Solicitation, NYSERDA, available at https://www.nyserda.ny.gov/All-Programs/Clean-Energy-Standard/Renewable-Generators-and-Developers/RES-Tier-One-Eligibility/Solicitations-for-Long-term-Contracts/2017-Solicitation; 2018 Solicitation, NYSERDA, available at https://www.nyserda.ny.gov/All-Programs/Clean-Energy-Standard/Renewable-Generators-and-Developers/RES-Tier-One-Eligibility/Solicitations-for-Long-term-Contracts/RFP-Resources; 2019 Solicitation, NYSERDA, available at https://www.nyserda.ny.gov/All-Programs/Clean-Energy-Standard/Renewable-Generators-and-Developers/RES-Tier-One-Eligibility/Solicitations-for-Long-term-Contracts/2019-Solicitation-Resources; 2020 Solicitation, NYSERDA, available at https://www.nyserda.ny.gov/All-Programs/Clean-Energy-Standard/Renewable-Generators-and-Developers/RES-Tier-One-Eligibility/Solicitations-for-Long-term-Contracts/2020-Solicitation-Resources; 2021 Solicitation, NYSERDA, available at https://www.nyserda.ny.gov/All-Programs/Clean-Energy-Standard/Renewable-Generators-and-Developers/RES-Tier-One-Eligibility/Solicitations-for-Long-term-Contracts/2021-Solicitation-Resources; 2022 Solicitation, NYSERDA, available at https://www.nyserda.ny.gov/All-Programs/Large-Scale-Renewables/RES-Tier-One-Eligibility/Solicitations-for-Long-term-Contracts/2022-Solicitation-Resources.

[19] https://www.nyserda.ny.gov/All-Programs/Large-Scale-Renewables/RES-Tier-One-Eligibility/Solicitations-for-Long-term-Contracts

[20] Case 14-M-0101, Proceeding on Motion of the Commission in Regard to Reforming the Energy Vision, Order Adopting Regulatory Policy Framework and Implementation Plan (Feb. 26, 2015) at 46. IOU ownership is permitted under the following circumstances: “1) procurement of DER has been solicited to meet a system need, and a utility has demonstrated that competitive alternatives proposed by non-utility parties are clearly inadequate or more costly than a traditional utility infrastructure alternative; 2) a project consists of energy storage integrated into distribution system architecture; 3) a project will enable low or moderate income residential customers to benefit from DER where markets are not likely to satisfy the need; or 4) a project is being sponsored for demonstration purposes.” Id.

[21] VMP Order at 26.

[22] See Case 15-E-0302, Proceeding on Motion of the Commission to Implement a Large-Scale Renewable Program and a Clean Energy Standard, Competitive Power Benefits for New Yorkers (Mar. 26, 2025).

[23] Id. at 5.

[24] Id. at 26.

[25] Id. at 26–27.

[26] Id. at 27.

[27] Id. at 12.

[28] Id. at 30.

[29] Case 07-M-0906, Iberdrola, S.A. et al., Order Authorizing Acquisition Subject to Conditions (Jan. 6, 2009).

[30] See id. at 95–100, 137.

[31] Case 06-M-0878, National Grid PLC & KeySpan Corp., Order Authorizing Acquisition Subject to Conditions and Making Some Revenue Requirement Determinations for KeySpan Energy Delivery New York and KeySpan Energy Delivery Long Island (Sept. 17, 2007), at 111.

[32] Id.

[33] Id. at 128.

[34] Id. at 134.

[35] Case 21-E-0303, Petition of National Grid PLC and NGV Ventures Emerald, LLC for a Declaratory Ruling Regarding Ownership of a 50 Percent Upstream Interest in the Calverton Solar Project, Declaratory Ruling on Generation Ownership and Making Other Findings (Sept. 10, 2021).

[36] Case 17-E-0016, supra, Order Modifying Divestiture Requirements (Nov. 18, 2022).

[37] Since 2019, Clean Energy Projects Totaling More Than 14,000 MW Have Completed the Interconnection Process, NYISO